Elite Pharmaceuticals Inc (OTCMKTS:ELTP) Crashes After Conference Call

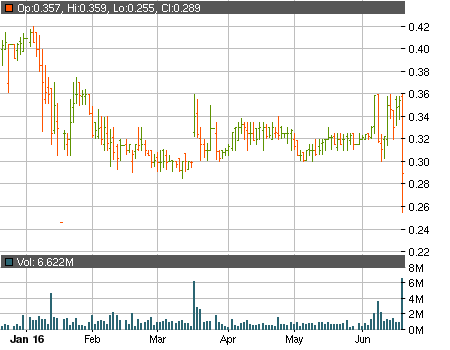

Yesterday Elite Pharmaceuticals Inc (OTCMKTS:ELTP) held a conference discussing their financial results for the fiscal 2016 ended March 31 while also providing a general business update. Unfortunately, the call seems to have failed miserably in meeting investors’ expectations with the stock of company suffering a painful crash during the session. When the closing bell put an end to the trading ELTP were sitting at $0.289 for a daily loss of more than 18%. This is the lowest closing price of the stock in close to eight months.

Apparently the biggest disappointment for investors was the business update because ELTP‘s financial results showed tremendous improvement on a year-over-year basis. Last Wednesday the company submitted its annual report and it contained the following numbers:

• $11.5 million cash

• $16.7 million total current assets

• $4.65 million total current liabilities

• $12.5 million total revenues

• $683 thousand net loss

As ELTP pointed out during the conference call this is the strongest balance sheet the company has ever had – compared to the results for the fiscal 2015 the revenues generated by the company have more than doubled and from $5 million now they stand at $12.5 million. ELTP‘s cash position has also increased significantly, growing by $4 million. ELTP is definitely far from being one of the typical pennystock companies but that does not mean you take the red flags around it are less serious.

During the twelve months covered by the report over 80 million shares were issued by ELTP. Out of that amount approximately 24 million were sold at an average price of $0.26 under the Lincoln park Capital Purchase Agreement while 48 million shares came into existence as an exercise of cash warrants. The subsequent events section reveals that even more shares were issued between March 31 and June 7 with another 5.5 million shares sold to Lincoln Park and 9.3 million shares issued through warrants. With the total proceeds from these last warrant exercises totaling $0.6 million each of these 9.3 million shares had an average price of less than $0.07.

ELTP could be in for a period of heightened volatility and opportunistic traders could be able to take some quick gains if they adjust their trades accordingly. The stock’s performance will also be influenced heavily by the FDA’s decision about ELTP‘s opioid abuse-deterrent candidate, SequestOx. The FDA has set a target action date under the Prescription Drug User Fee Act (PDUFA) of July 14, 2016.