Mount Tam Biotechnologies Inc (OTCMKTS:MNTM) Reaches New Heights

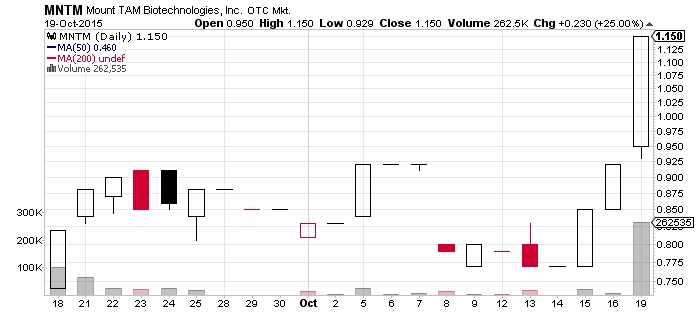

Mount Tam Biotechnologies Inc (OTCMKTS:MNTM) jumped a sizable 25% yesterday which means that it burst through the $1 per share barrier and it closed the session at an all-time high of $1.15 per share. That’s a bit strange.

Mount Tam Biotechnologies Inc (OTCMKTS:MNTM) jumped a sizable 25% yesterday which means that it burst through the $1 per share barrier and it closed the session at an all-time high of $1.15 per share. That’s a bit strange.

The company as we know it has only been around for a few months. It’s the result of a reverse merger between a public entity that was previously in the business of selling premium cigars and a development stage biotech company that reckons it can come up with a treatment for Lupus.

There haven’t been many press releases since the merger. In fact, the only one we can see was published last week. It says that MNTM now has a new Chairman of the Board and we can also gather from it that the company has yet to file an investigational new drug application with the FDA.

The more experienced among you know that the FDA approval process takes years and millions of dollars. Time is a relative thing, but the same can not be said about money. And money is something MNTM simply doesn’t have.

When the reverse merger was closed the new management team published the financial statements of the new subsidiary in an 8-K form. Here’s what the figures looked like on June 30:

- total assets: $22 thousand in cash

- current liabilities: $1.2 million

- NO revenue

- quarterly net loss: $425 thousand

In light of the financials above, few people will believe that MNTM really is about to change the way people treat Dr. Gregory House’s least favorite disease. All in all, there’s very little to suggest that this is the case. Nevertheless, many investors have already put their money on the line which means that they should be aware of all the dangers. And once you dig really deep, you’ll see that there’s a few of them.

Several years ago, when MNTM (then known as Tabacaleraysidron Inc.) was still private, the company raised $274,500 by selling 2,745,000 shares at $0.10 apiece. When Tabacaleraysidron was going public, the people who took place in these placements offered their stock to the public at $0.20 per share. We don’t know how successful the offering was, but judging by the Beneficial Owners section in the 10-K’s that came out after the stock was listed on the OTC, some of the aforementioned people got to keep their shares. They’re probably quite happy at the moment.

In July, shortly before the closing of the acquisition, the company effected a 5.75 for 1 forward split which means that the people who bought 2,745,000 shares for $274,500 could now be holding as much as 15,783,750 shares of MNTM common stock.

These, for the record, cost about $18.1 million at yesterday’s close, and their value might increase further should a paid pump were to come out of nowhere.