The Pump for IFAN Financial, Inc. (OTCBB:IFAN) Is Still Active

Even after a month the paid promotion for the stock of IFAN Financial, Inc. (OTCMKTS:IFAN) seems to be in full swing. The landing page created by Doc McShane is still online while on message boards investors are continuing to report receiving the hard mailer brochure. Well, with a disclosed budget of $3.5 million the campaign may even run for quite a while longer.

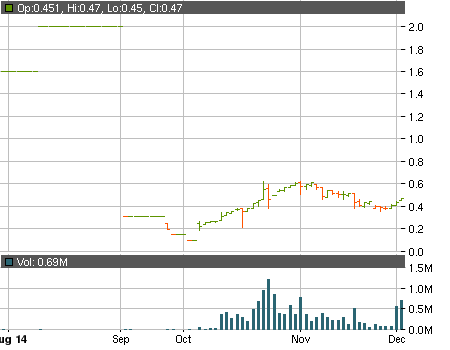

The artificial hype created by the pump is still attracting the attention of the market and yesterday IFAN registered its biggest daily volume for the past month. Traders shifted 695 thousand shares pushing the stock another 6.8% up to a close at $0.47.

IFAN displays some of the typical characteristics of a pumped stock. In our previous articles we already discussed the dreadful financial state of the company from a few months ago. Their annual report should have been submitted by the end of November but, alas, that didn’t happen. Yesterday a notification of late filing was filed though and according to it the annual report should be completed by December 15.

Last Tuesday the company was able to boost its cash position through a subscription agreement with an unnamed accredited investor. Under the terms of the deal IFAN sold 3.7 million of its shares for total proceeds of $1 million. Although the shares were priced at just $0.27, a discount of more than 40% to the current market price, at least for now they are restricted and cannot be sold on the market.

There are however millions of extremely cheap shares that were issued in the past and that are free-trading. During the nine months ended May 31, 2013, a group of seed shareholders bought a total of 214 thousand shares for just $5350. On September 3, this year, a 140-for-1 forward split turned those shares into more than 29 million that could bring some hefty profits to their owners thanks to the increased awareness created by the pump.

If you are determined to trade IFAN’s stock be sure to do your own due diligence. Consider all the red flags and adjust your position accordingly.